BY REID WILSON

Thursday, December 23, 2010 | 6:27 a.m.

MAX WHITTAKER/STRINGER

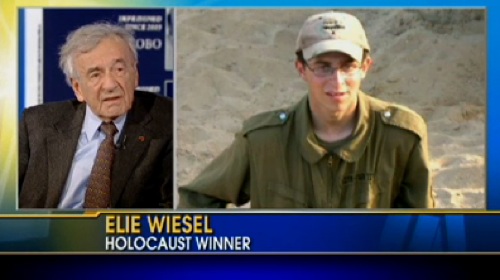

Nevada, a perennial battleground, is one of the western states that picked up a congressional seat in the latest reapportionment.

The decennial census has told the same story for the better part of a century--it's a story of exodus from the Northeastern and Midwestern regions and of an exploding South and West, a migration from the cold winters of industrial demise toward the bright sun of economic innovation. But although the media says the population shifts indicate a change in the partisan balance of power, the real story is far more complex. No one should believe that Democrats have had their heads handed to them this decade.

Instead, the reapportionment process foretells a changing dynamic of American politics, one in which minority voters will play an increasingly important and influential role. The eight states that will gain House seats this year appear to give Republicans an advantage, but, in truth, the redistricting playing field is far more level.

Eight states--Arizona, Florida, Georgia, Nevada, South Carolina, Texas, Utah, and Washington state--will gain representation when the 113th Congress convenes in 2013, figures released on Tuesday by the Census Bureau showed. On its face, those states appear to give Republicans an advantage; they hold complete control of redistricting in all but Arizona and Washington, where bipartisan commissions will draw the new lines.

The outsized growth of those eight states, however, has come largely from dramatic increases in minority populations, particularly among Hispanic voters. Although exact data on race collected by the 2010 census won't be available for a few months, trends and the American Community Survey, conducted by the Census Bureau, demonstrate that those predisposed toward voting for Democrats have constituted the bulk of the new population boosts.

Civil Rights Versus Partisan Gerrymandering

In six of the eight states, minorities now make up more than a quarter of the population. The 2000 census showed that Hispanics and African-Americans constituted 28 percent of the population in Arizona, 31 percent in Florida, 33 percent in Georgia, and a whopping 43 percent in Texas. That growth has continued; the ACS estimated that those groups now make up more than 33 percent of Arizona's population, 36 percent of Florida's, 37 percent of Georgia's, and 47 percent of Texas's. The 2010 census will certainly show those numbers growing again.

Legislators drawing boundaries will have to account for these minority populations, thanks to Section 5 of the Voting Rights Act. That provision requires certain states and jurisdictions to "preclear" district boundaries with the Justice Department in order to allow for majority-minority districts. Section 5 applies to Arizona, Georgia, South Carolina, and Texas (it also applies to Louisiana, which is losing a seat this year). This means that those states will have to ensure that their burgeoning Hispanic and African-American populations will have the chance to be districted together in largely Democratic areas. Although such districts already exist, larger minority populations in many cases mean that Republican-held districts will include more voters predisposed toward voting for Democrats.

It's important to note that majority-minority districts aren't always guaranteed Democratic seats. In 2010, Reps. Ciro Rodriguez and Solomon Ortiz, both Texas Democrats, lost to Republican challengers in districts in which more than 65 percent of the population is Hispanic. Rep. Sanford Bishop, D-Ga., whose district has a narrowly African-American plurality, barely escaped an upset.

But it's also true that characterizing the nation's eight big-growth states as Republican misses a broader change in American politics: Minority voters and changing demographic trends mean that those states are less reliably GOP than they have been. Washington state is solidly blue, resisting even the 2010 wave toward the Republicans. Florida and Nevada are perennial battlegrounds. President Obama's 2008 campaign saw fleeting signs of hope even in Arizona, the home state of his Republican rival, Sen. John McCain. In 2012, Arizona will certainly top Democratic target lists. And with the exploding Hispanic population, some Republican strategists are worrying about their chances for maintaining their grip on Texas's Electoral College votes over the long run.

The history of reapportionment and redistricting also demonstrates that partisan control of a state's district boundaries means less than the controlling party might hope.

Drawn Into Failure

Consider the last decennial redistricting, when, as now, eight states gained seats and 10 states lost seats. In 2002, the first year in which new lines were employed, Republicans picked up eight House seats nationwide, giving then-Speaker Dennis Hastert a GOP majority of 229 seats. Some of the Republicans who entered the 108th Congress as freshmen looked safe for the long haul--Rick Renzi of Arizona, Bob Beauprez of Colorado, Max Burns of Georgia, Tom Feeney of Florida, and Jon Porter of Nevada.

None is in Congress now. Renzi was indicted on corruption charges; Beauprez lost a governor's race in humiliating fashion; and Burns, Feeney, and Porter lost reelection bids. In the 111th Congress, Democrats held all five of those seats.

The seats first created for the 2002 elections were, largely, swing seats. This year's midterms returned Republicans to four of the five seats. (Only Rep. Ed Perlmutter, the Colorado Democrat, survived.)

Republican success in the 2010 midterms extended so dramatically to state legislatures that the party now controls the redistricting process for 196 seats, four times the number of seats over which Democrats have complete control. But courts have shown an aversion to blatantly partisan gerrymandering not sanctioned by the Voting Rights Act, and if independent voters have proven anything in the last three election cycles, it is that their partisan loyalties are fickle.

In other words, reapportionment by itself is no guarantee that one party or another will reap major rewards. Instead, partisan results depend on data focusing on where minority populations have moved, and this information has yet to be released by the Census Bureau. Legislators themselves, who may hope to bolster their party's majority in Congress, will have to use their pens carefully. Draw a district that has only a small partisan advantage and run the risk of allowing a wave election to sweep a Democrat in office.

Democrats certainly could have gotten better news from the decennial reapportionment. Some of the party's stalwarts will undoubtedly be targets in states that are losing seats, such as Massachusetts, New York, Ohio, Michigan, Illinois, Iowa, and Missouri. But rumors of a massive Republican sweep are misleading. In fact, in the long run, the voters who guaranteed Sun Belt states their new congressional seats will likely turn those states, slowly but surely, into promising Democratic targets.

History shows that the story of redistricting starts, not ends, with census, reapportionment, and redistricting.

Check out how difficult it is to draw your own districts, courtesy of an excellent game crafted for the University of Southern California's Annenberg Center: We could waste hours playing The ReDistricting Game.